Our Solutions: Conditional Payment

We provide flexible and secure conditional payment infrastructure powered by PBM3525, supporting a wide range of applications.

Status Quo of Payment

Traditional payment methods (Peer-to-Peer or Smart Contrat Payments) fail to meet the security, convenience and flexibility demands of modern users, whereas conditional payments are a perfect fit.

Peer-to-Peer Payments

- Primitive and simple

- Irreversible transactions

- Address-based payment

- Full control and responsibility tied to the private key

- Prone to errors, such as sending funds to the incorrect addresses

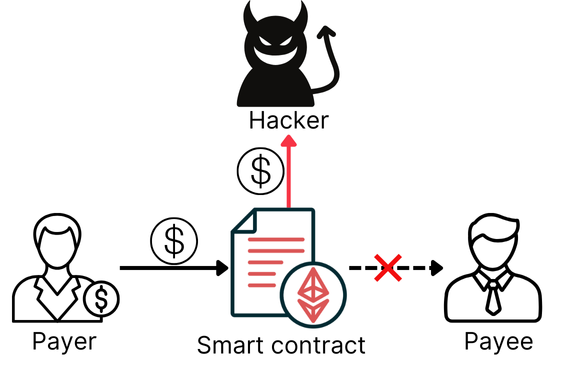

Smart Contract Payments

- Extremely flexible

- Enable unlimited possibilities for payment logic

Highly programmable and code-driven - Complex and incomprehensible for non-technical users

Adaptable to all scenarios - High risk for misuse or exploitation

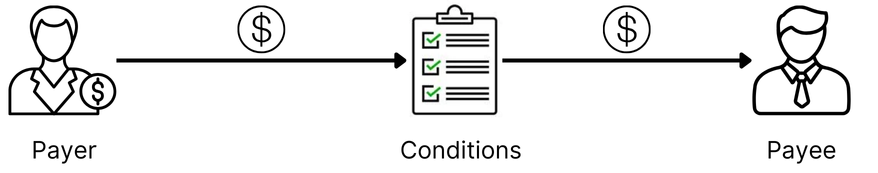

Conditional Payments

- Supports a limited number of predefined payment logics (convention over custom programming)

- Document-driven and WYSIWYG*

- Clear and easy for all users to understand

- Promotes standardization and minimizes security risks

- Addresses most real-world scenarios

Why Conditional Payments

Conditional payments are payment modules that execute only when predefined conditions are met, offering configurable, composable, visualizable, and secure logic for general payment scenarios.